Signatures for drawdown paths - A primer

A primer into using signature transform for modeling drawdowns

Published on November 01, 2021 by Emiel Lemahieu

Signature transform Drawdowns

1 min READ

My other projects hinge on the concepts of paths and path signatures as prerequisites. In the words of Terry Lyons1:

The key idea behind signatures is to stop thinking about a path as a quantity evolving over time, but rather as an object that you can query over intervals. As one queries these intervals, one gets a natural description about what happens with the system at different time scales.

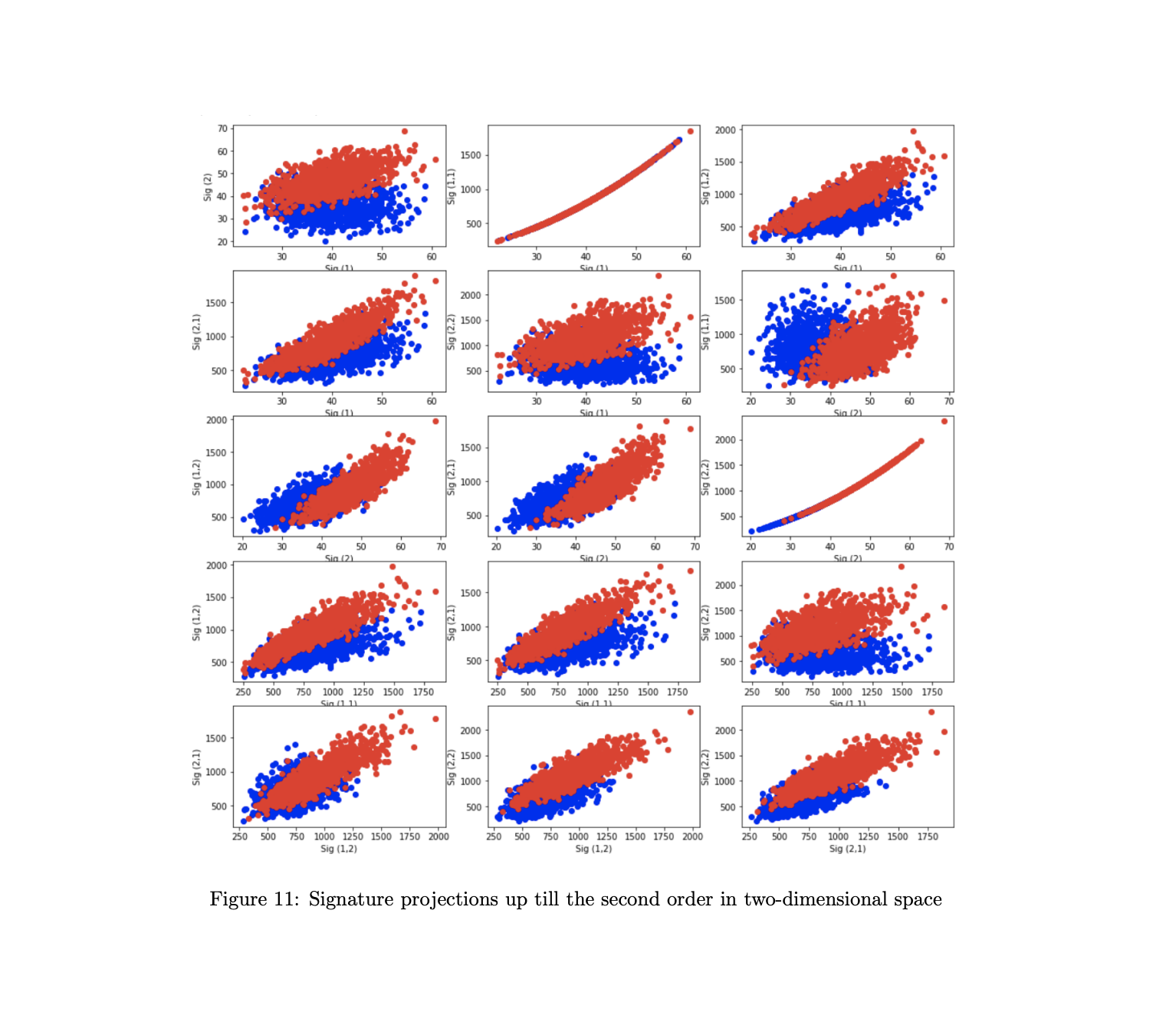

The primer (based on Chevyrev et al. 2016) compiles my notes from a literature review on the signature transform, and includes two examples related to portfolio drawdown:

- Classifying high- and low-drawdown stocks in terms of next period expectation using signature transformed previous period paths as features.

- Distinguishing between high- and low-codrawdown regimes using signature embedded paths.

Preview

Download

Download the pdf below:

Signatures for drawdown paths: A primer.

References

Reference to this quote and highly recommended is this introduction to signatures and rough path theory given by Terry Lyons at the Royal Statistical Society in 2022 included above. ↩